Understanding the coworking industry

Running a successful coworking business is half science, half art – it’s a combination of space allocation and relationships, of managing furniture budgets and managing client expectations. Over the past decade, the coworking industry has grown past shared desk rentals and now represents a wide range of business models, lease structures, and amenity levels. Forewarned is forearmed, so let’s start with the global facts about the industry and work towards the specific coworking space that’s right for you and your goals.

Current state of the industry

At DenSwap, we heavily focus on research and insight to bolster our years of experience in owning, operating, consulting, and selling coworking spaces. Craig Baute, partner at DenSwap and the lead researcher for the Global Workspace Association, oversees our ongoing research on the state of our industry.

As of February 2020, we’re tracking 4,896 individual coworking spaces across the US. Approximately two new coworking spaces open every day. The majority of spaces (2,910, or 59.4%) are independent spaces – one-off coworking spaces owned by a private entrepreneur or property owner.

Once a brand opens a new location or campus, we classify them as a chain. Thrive Workplace or Creative Density in Denver are two good examples of this trend – these are spaces that started with a single location (typically near a city core) and then expanded their brand to open sister spaces in underrepresented suburbs and exurbs in the surrounding metro. We also commonly see growth patterns where a location is opened in qualifying cities in a region (say, one location each in Memphis, Nashville, and Birmingham.) With the collapse of WeWork and general investor skepticism of too-big-to-fail corporate coworking, we see the rise of regional chains as the near-term future of the industry. Currently 765, or 15.6% of coworking locations fit this category.

Corporate coworking is what most industry outsiders are familiar with – WeWork and Regus dominate this category, with upstarts like Industrious and Novel Coworking gaining market share after WeWork’s failed IPO. These corporate chains can have wildly different business models: WeWork notoriously leases all their properties while Industrious has management contracts, and Regus is mostly executive suites opposed to a New Shared model. Almost all corporate brands seek to establish locations in the top 20 cities in the US as opposed to regional models. 1074, or 22% of all coworking locations, fit this category.

The final (and smallest) category is franchise coworking, where a franchisor licenses its know-how, procedures, intellectual property, use of its business model, brand, and rights to sell its branded products and services to an otherwise-independent operator. Venture X and Serendipity Labs are good examples of this recent trend. Together, franchise brands account for 146, or 3%, of all coworking locations to date.

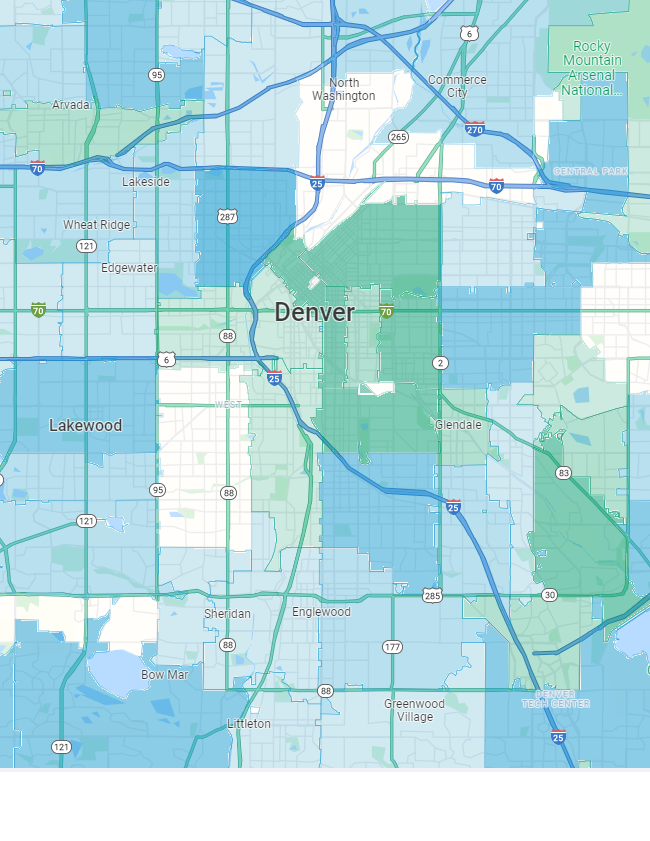

For more information on industry types, we’d like to invite you to DenSwap’s Coworking Heatmap – a tool we built for ourselves and published online for our buyers to make informed decisions when planning their expansion. The coworking heatmap allows you to narrow in on the presence of the four types on a US map and pull trends out. (E.g., are there more corporate coworking spaces in Memphis or Phoenix? What cities did WeWork overlook?)

Find underserved neighborhoods for your next coworking location.

Open the Coworking Heatmap to research trendsDifferentiating coworking types

We differentiate coworking into three types: executive offices, traditional coworking, and new shared. Although there is wide overlap between these terms with no formal definition or certification board, we generally define the categories as follows:

Executive offices are the earliest coworking model and generally consist entirely of private offices with little-to-no shared spaces other than a kitchen/break room and conference rooms. They are most often used by traditional small businesses (lawyers, accountants, etc) who desire privacy over collaboration. Executive offices often price their rooms by the square foot, and most services come at an additional cost (internet, phone, virtual mail, etc). Regus is the most well-known example of an executive office chain here in the US.

Traditional Coworking is the opposite of executive suites – everything is shared space without any offices. The first generation of coworking businesses ran this model, although it’s become less prominent in recent years (many coworking spaces that started out with a desk-only model have since added dedicated office space to their locations.) Tenants can typically choose from “hotdesking” – a subscription type that allows them access to the space for a limited time each month (4 times a month, 3 days a week, etc) – or opt for a permanent, dedicated desk. The services and amenities (internet, coffee, furniture) are typically included with a subscription. In most cases, subscriptions are month-to-month and have a fixed flat rate.

New Shared coworking is the model that blends the two – a minority of the space is a shared collaborative hotdesk area, with the majority of the space dedicated to private offices. Aside from the inclusion of offices, this type is closer to Traditional Coworking with its focus on community and service as the primary driver of client retention. WeWork, Industrious, and most other corporate and independent spaces use this model.

Differentiating business models

At its core, coworking is a blend of location and services. For the coworking owner, the building, buildout, and location of the space is a critical part of their future success. For the landlord, coworking must be more than an occupancy play – the level of consistent service and day-to-day management must be on point if the space is to be successful.

Traditional Leases are the standard business model for coworking spaces – coworking owners find a suitable place and then rent from the landlord. Typically, the landlord will give free months of rent equal to one month for every year of the lease and a buildout allowance (average 12 to 24 months of rent) when signing the lease. Most leases are 5-10 years with the deposit paid back over time. The coworking owner pays the monthly rent and runs the business and operations, keeping all profit from the space.

Management Contracts are a newer model where the landlord and coworking operator partner together to share in the risk and rewards for the business. There’s no one “management contract” model – it depends on what the two parties are comfortable with – but we’ve seen a few rise to the top. A full share model has all expenses and profits split between the parties – say, 30% of the expenses (including rent and buildout) are paid by the coworking owner, who receives 30% of the profit. Full shares are more common among regional chains, where the structure allows them to grow a brand with multiple locations quickly without spending too much time on any one location. Other management contracts might involve a smaller share of profit/revenue (10-20% is common) in exchange for brand and operations management without any expense sharing by the coworking owner, or an Industrious-style model where full expenses are paid by their respective owners (landlord pays buildout, coworking owner pays ongoing expenses) and then the profit is split between the parties.

Finally, franchise models have been growing in the US with Venture X, Serendipity Labs, and a few other companies operating. These most resemble traditional leases, but the coworking owner typically pays 5-10% of top-line revenue in exchange for use of the brand and operations materials (employee guides, policies, recommended buildout structure). Upon close of a space, the franchise typically has first rights to purchase the location.

Next Steps

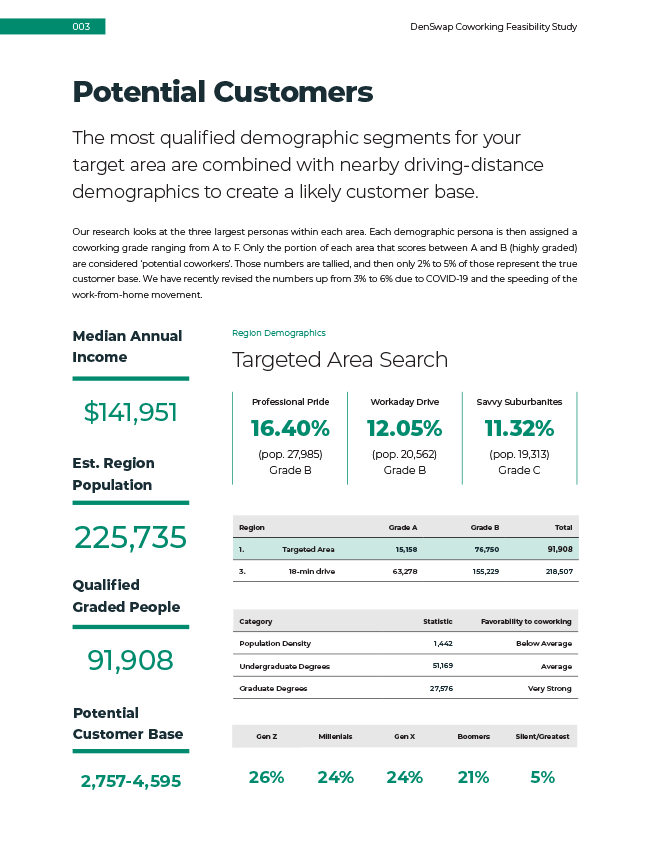

Ten years ago when coworking was brand new coworking spaces followed a build-it and they will come mindset. As competition as increased that approach doesn’t work anymore and it’s important to study the competition and know the local market. You really need to answer the basic questions of 1) What type of worker lives in the 20 minute drive radius and how many are there? 2) How many coworking spaces are there and do they meet the needs of that group? These are important questions that a lot of coworking space owners don’t examine hard enough.

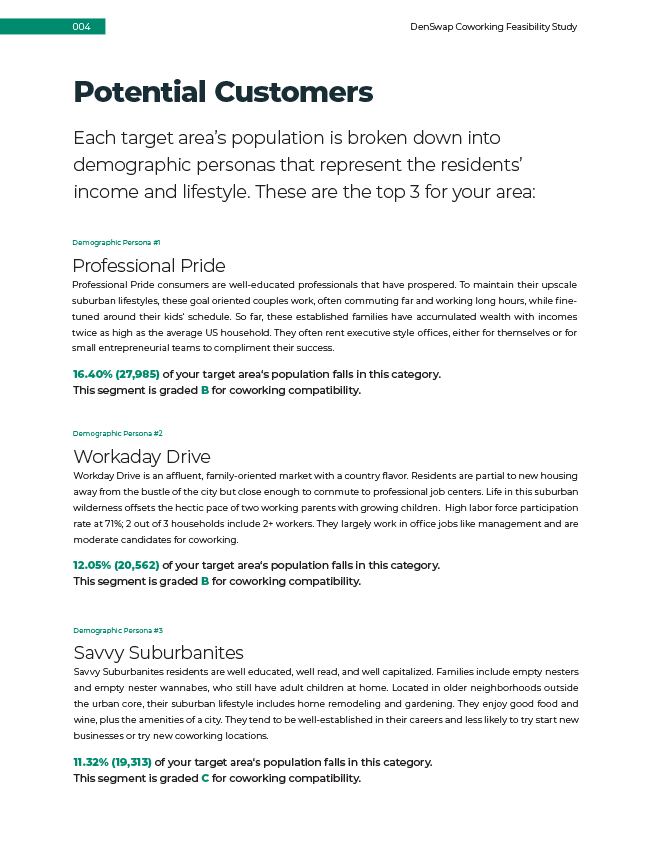

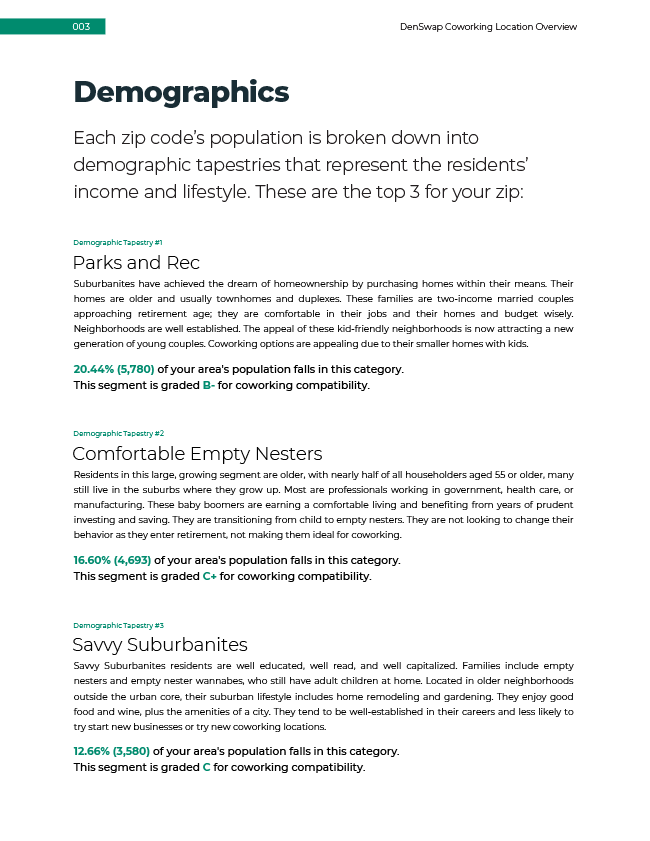

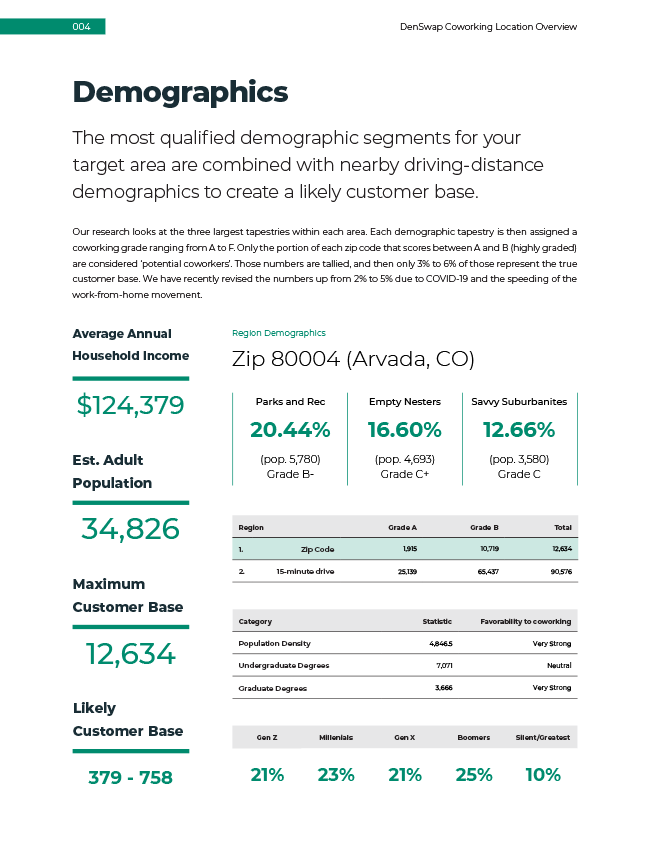

There are a lot of ways to judge the number of potential customers. The most common ways are to create a community before you open through Meetup groups and local online surveys or through market research. Market research is performed by using data bases to discover how many people live in the area with characteristics and behaviors that mimic others that cowork. Common coworking member characteristics are individuals between 25 to 50 years of age, college educated, work remotely or for a small business, and are in the fields of software, marketing, or advertising. If you’re not sure whether your local market is able to support a coworking location, reach out to us for additional support – our consultants can research the area and provide pinpoint recommendations on your local demographics, how many customers are in your area, and how much space should be allocated for your market.

Our team can review your particular property and market, and create an actionable plan to get your started.

Commission a Focus & Feasibility Report from DenSwap’s consultantsAdditionally, DenSwap has created helpful tools to help answer some of the competitor questions. The Coworking Heatmap was created to visually show where coworking spaces are located throughout the US and they are categorized by independent spaces, chains, executive suites, and popular brands. The Coworking Heatmap is a good starting point. It’s recommended you then visit each space to learn their style and position in the marketplace.

Once you have the research and determine coworking can succeed in the area, then take a look at the marketplace or go to DenSwap’s comparison tool to learn the best way to start a coworking space.

Get set up for success.

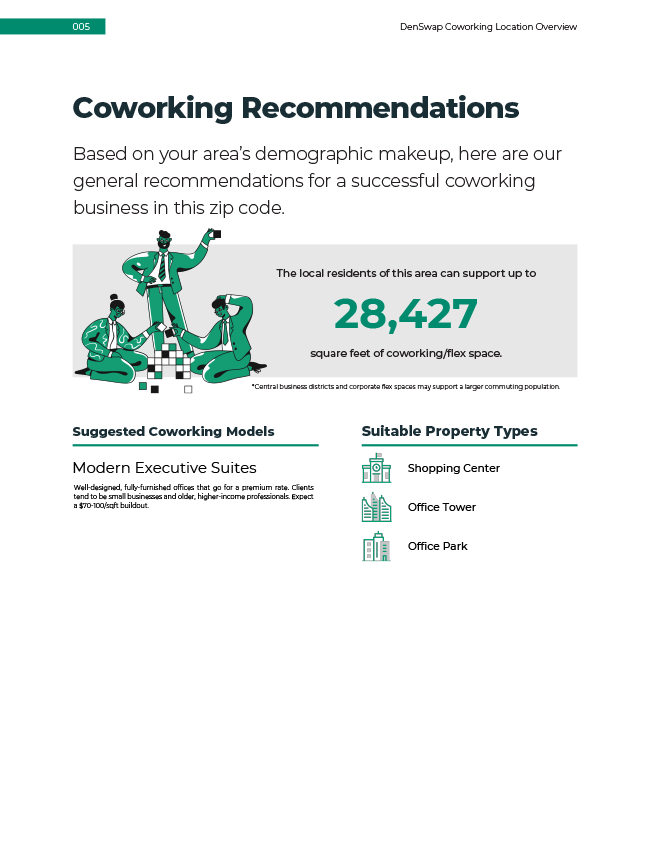

Entering the world of coworking is exciting and scary. We’ve been there before – we’ve started our own successful brands, have helped investors and operators around the world start their own brands, and are here to help you as well. Whether you purchase an existing space or start your own from scratch, we’re here to help.