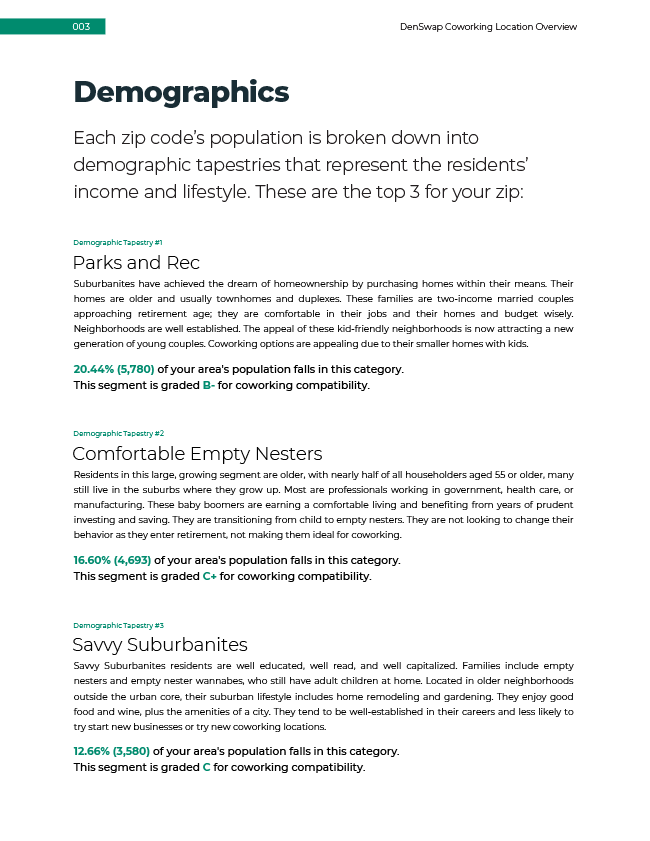

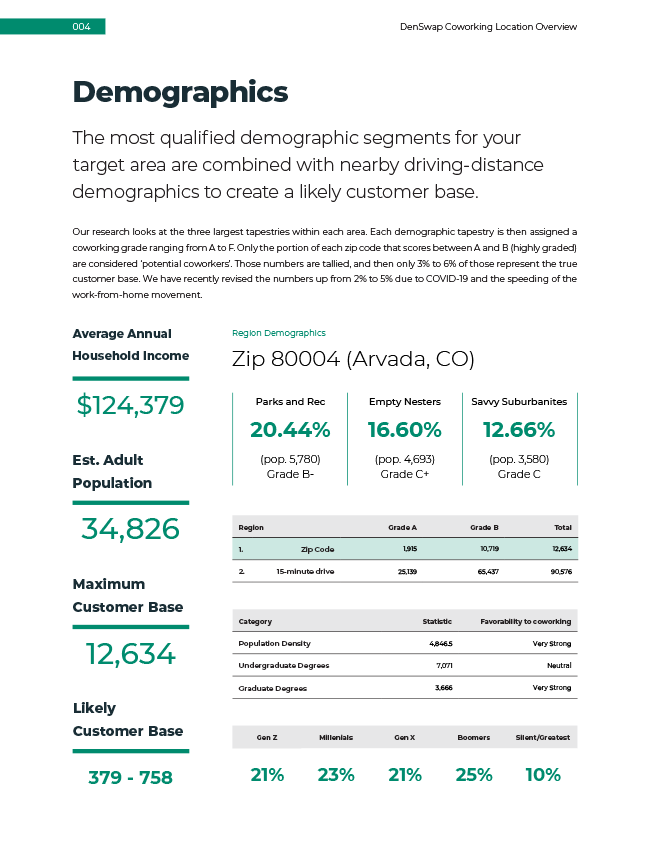

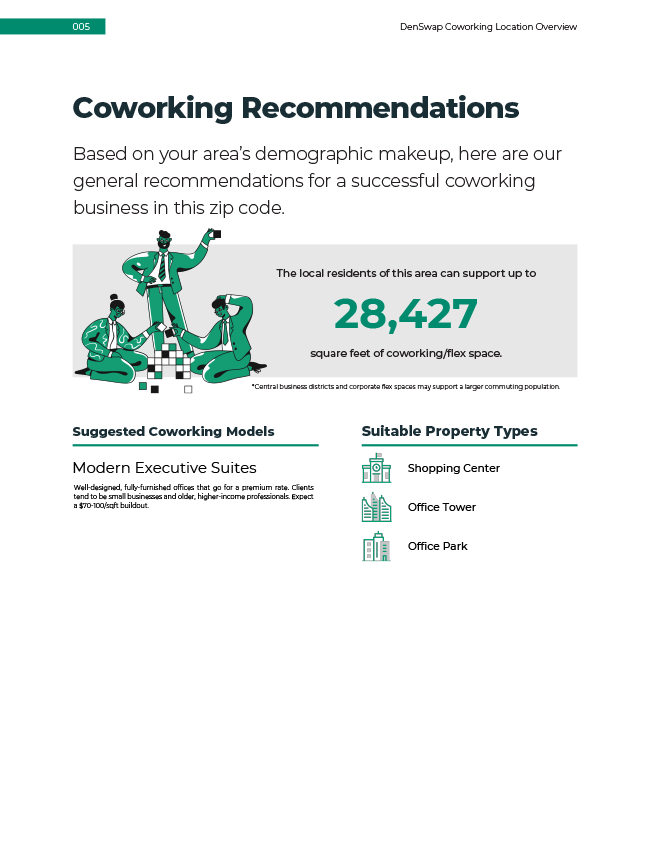

Do you own a building or have ever looked at expanding into Jacksonville, Florida? This week we used our Coworking Analytics Engine and found neighborhoods we’d avoid, several that are OK, and one that would be a home run.

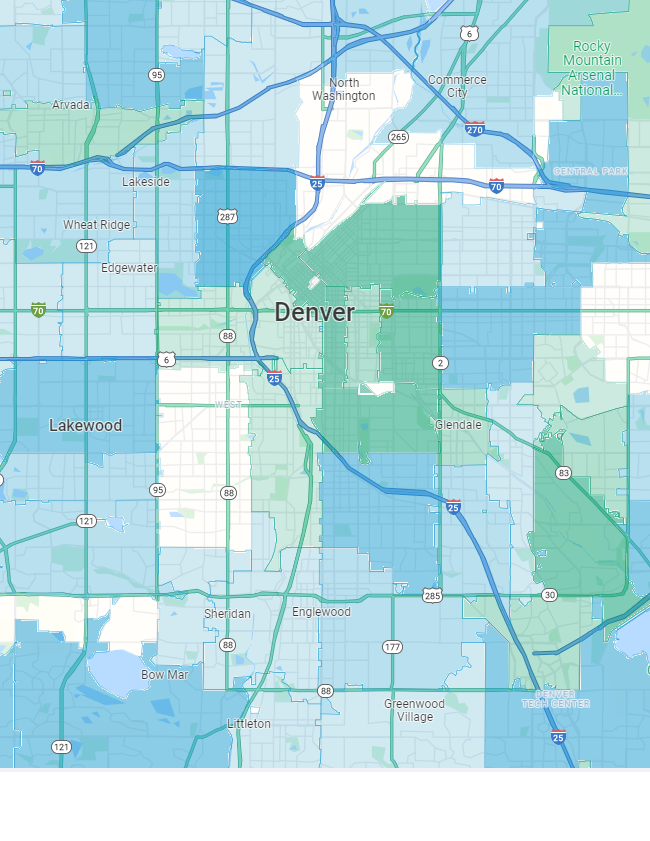

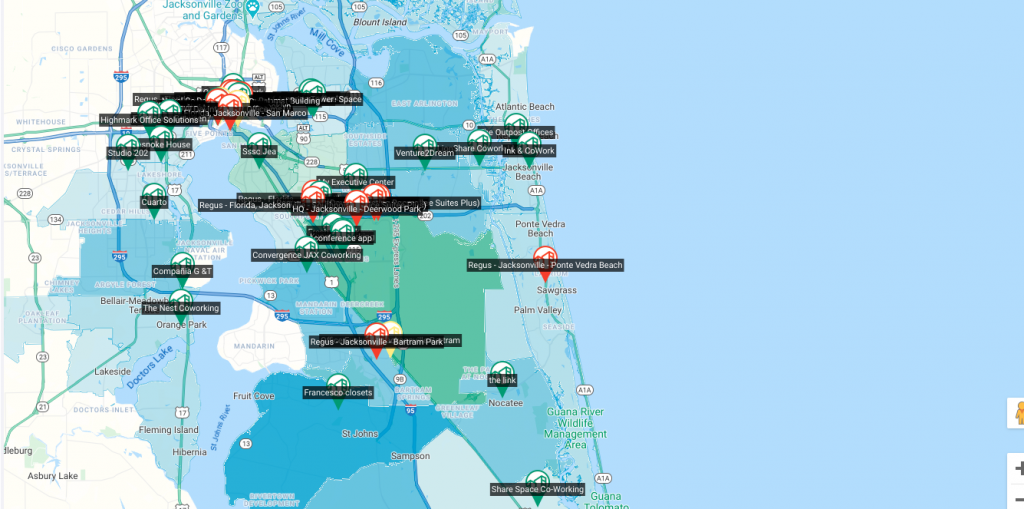

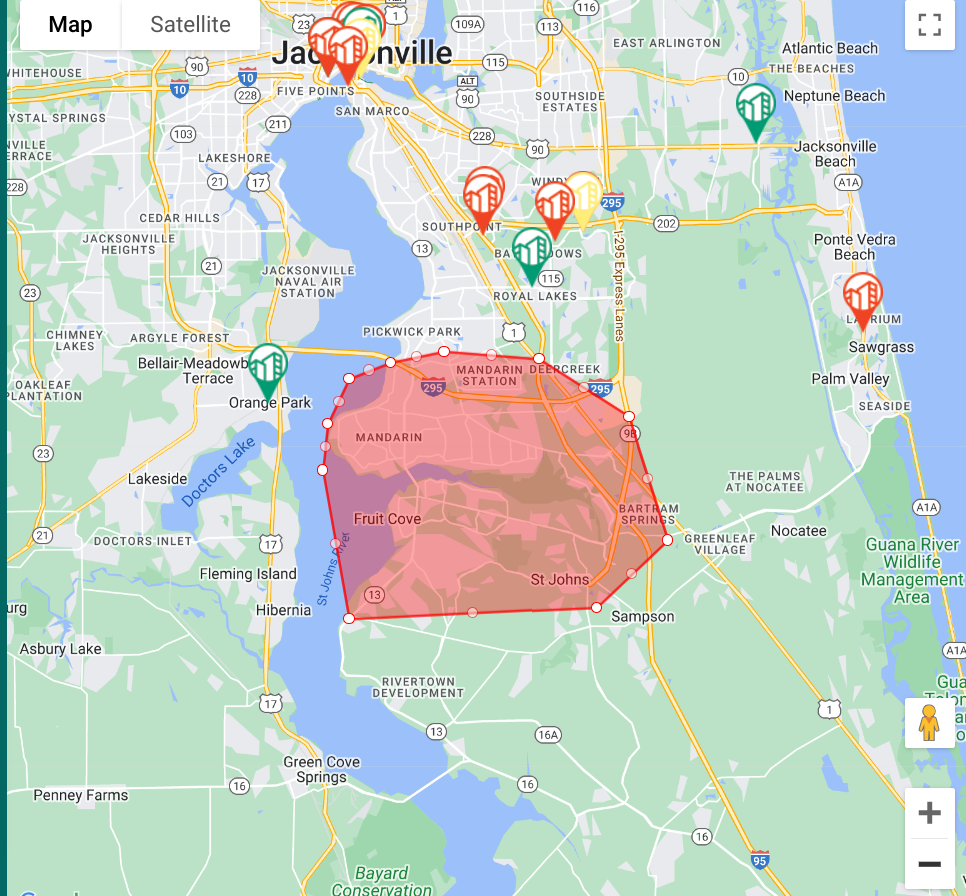

First we take a look at the city using our Demand Overlay. This tool makes it easy to scan an area to identify areas where a lot of customers live, but competition is low. The green indicates groups of a customers that favor a blend of desks and offices with an emphasis on design, collaboration, and creative amenities and vibe. The blue indicates groups that favor offices in an Executive Suite design. The darker the color the higher the number of customers.

Birdseye View using our Demand Overlay

After a quick scan of the Demand vidual, we can identify St. Johns in the south suburbs of Jacksonville as a region with little competition but a high concentration of customers. The interstate run through the city meaning the city can draw additional customers where competition is light, mainly from the south.

After an area opportunity is identified, the next step is to study the region in more detail.

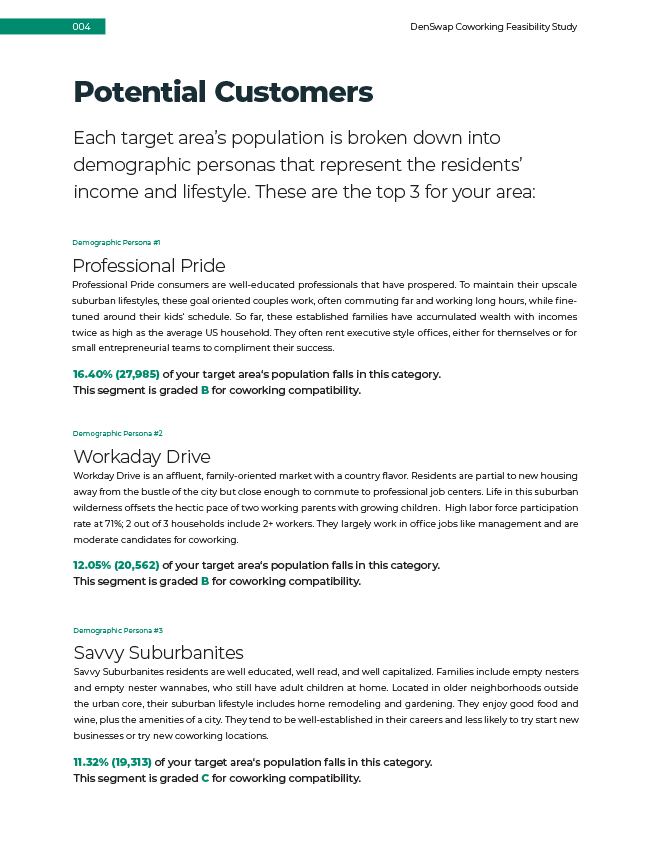

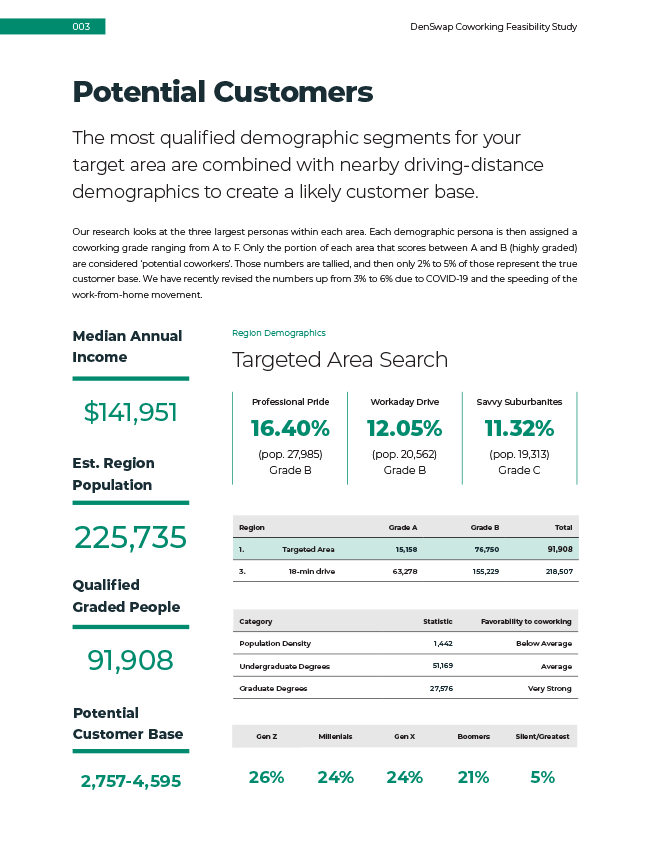

Demand Analysis for a Custom Coworking Radius

DenSwap’s tool allow us to outline an exact area where most customers will likely come from. This custom target area is based on where people will be driving from and discounts areas with competitors. This is a much more detailed and accurate than the dot and 1, 3, 5-mile circle census data. You don’t want to assume customers will drive pass 3 coworking spaces to get to yours.

After running our Coworking Demand Analysis Engine we quickly discovered some revealing opportunities for buildings to be converted into coworking.

Current Supply: 40,000 SF direct, 80,000 SF nearby

Projected Demand: 348,327 SF

Unmet Coworking Demand: 308,327 SF

Based on these results, St. Johns has all the hallmarks of a growing suburb where coworking supply hasn’t kept up with demand. It’s 25 minutes from the downtown core of Jacksonville and is where young families have flocked for cheaper housing. The average household income is over $126,000, with Millennials being 29% of the population with young families and professional jobs. Gen X is 22% of the population and settling into a routine that relies less on a traditional office, but the difficulties of having an active house with kids and teenagers have them seeking coworking solutions. St. Johns is also young with 26% adult Gen Zs.

Potential St. John’s Coworking Population:

Desk-Focused Audience: 33,181

Office-Focused Audience: 121,631

Likely Coworking Customers: 4,644 – 9,289

Recommended Type: Mid-Flex, High-Flex, Modern Executive Suites

Suitable Type of Properties: Shopping Center, Mixed-Use, Office Park

How to use this data for smarter investments

If you are a building owner with empty space looking to start driving revenue, then our data and feasibility reports will help you make a decision on whether or not coworking will be a profitable new business and smart investment. In St. Johns there is a very clear opportunity for coworking to succeed whether it was 5,000 SF or 40,000 SF space.