The big guys in the shared office world, IWG of Regus and SPACES, have focused their spotlight on the coworking shift that DenSwap was built for. In a Loopnet interview, executives discuss how their new concept will focus on smaller locations in top-tier locations with a profit-sharing partnership with landlords holding vacant retail locations. They envision a hub-and-spoke model with larger locations remaining at the center and smaller locations in the suburbs and urban neighborhoods. They hope to have 5 to 20 locations in the next year and it will be under a new SPACES DESKS brand.

IWG is shifting their strategy, but I think the really intriguing insights from the interview points to industry-wide trends for the commercial real estate industry and the coworking world. Here are a few key takeaways from the strategy shift and how smaller landlords and coworking operators can react.

Create smaller spaces that are convenient to get to.

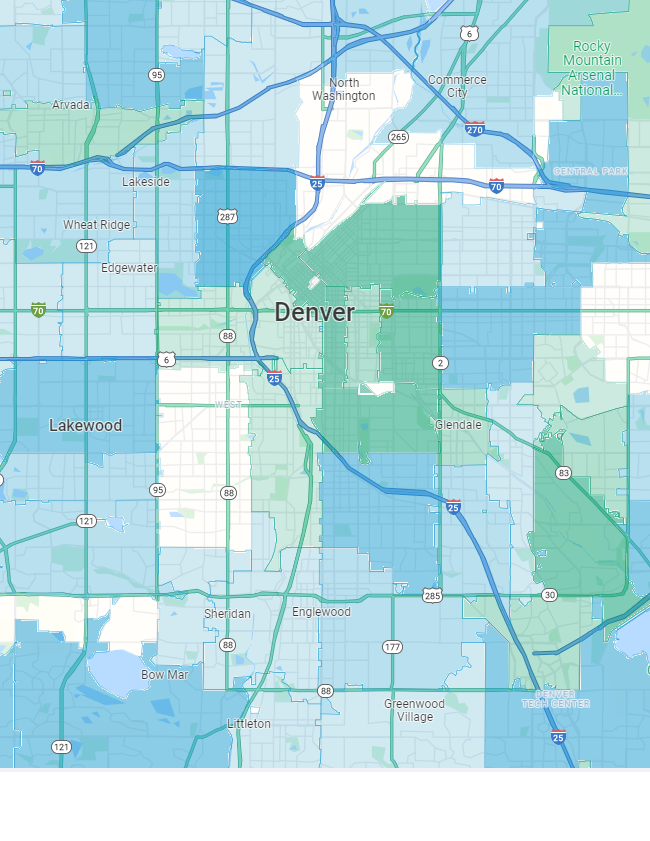

Remote Workers don’t want a long commute and want to avoid public transportation. IWG is building their new spaces in the suburbs and neighborhoods where people live, not downtown centers. They are building smaller coworking spaces that can remain profitable with only a few hundred members.

The DenSwap consulting team has been working with landlords and coworking operators that identified this trend and are making plans to go after the same market. They want to create smaller ‘neighborhood spaces’ that serve the immediate community within a 15 minute drive or bike.

Convert Retail into Flex Offices

The neighborhood coworking spaces that IWG is looking to open will fit between 40 to 100 workstations. Based on industry standards that DenSwap has studied, this means the spaces will be around 4,000 to 7,000 square feet. This is in the range of vacant retail locations that have been hit hard by the pandemic and recession.

Most landlords with larger empty retail space don’t expect it to fill up in the next several years, if at all, as shopping habits dramatically shift to online. Many landlords anticipate having to repurpose their spaces for the changing times and coworking is nice fit.

The DenSwap team has found that retailers with vacant units in active strip-malls, lillypad units, or in urban neighborhoods are a good potential partner for coworking operators.

How many members can the new neighborhood coworking concepts have?

If the neighborhood spaces are between 4,000 and 7,000 square with 40 to 100 workstations, then generally they can have membership counts 1.5x to 3x the number of desks. This means that the new SPACES DESKS by IWG and similar independent spaces will have 60 to 300 members as their total capacity. These lower numbers show that they are designed to serve the 15-minute radius of the location versus former downtown hubs that serve hundreds to thousands of workers at each location.

Partnerships with landlords versus traditional leases

IWG executives explained that they are approaching this new market through profit-sharing arrangements versus a traditional long-term lease. Jarmin from IWG explains ‘For the lalndlords, there’s no investment’ …’At least they’re making money in the interim.’ IWG is working with the landlords to build out the space and share in revenue. They rather bluntly explain that once the space is up and running that the landlord will actually be collecting some revenue and keeping their strip active versus it sitting empty and not seeing any checks come in.

At DenSwap we have seen partnerships between landlords and coworking space operators make a lot of different arrangements. (You can run your property through our property planning tool) The most common management contract allows the landlord to collect a lot more rent when the landlord pays for buildout to improve the space and collects all of the coworking revenue until market-rate rent and expenses are covered. This arrangement allows the owner to keep more of the future monthly cash flow and keep the overall value of the building high.

One Membership – Multiple Locations

IWG expects the new remote workforce to stay close to home most of the time but may still need to travel for meetings within the city or across the US. IWG has the benefit of having over 3,200 locations through their Regus, Spaces, and other brands. They are going to develop their own app to allow an individual to purchase one membership and have access to all of their locations.

There are several companies that are helping small businesses and Fortune 500 companies manage their dispersed workforce with a centralized membership. If a local landlord or coworking operator wants to compete with IWG or WeWork then the DenSwap team recommends listing their spaces on DeskPass, LiquidSpace, and Upsuite. DeskPass is a membership that allows a company to onboard some or all of their employees and have access to independent and chain coworking spaces. This is a way to directly compete against IWG and WeWork.

Focusing on New Non-Shared Amenities

Most coworking spaces have large shared kitchens, long bench seating for people to gather and work, and games for people to socialize. Those amenities are not in demand during COVID. IWG is changing how spaces are designed with their new neighborhood SPACES DESK concept and instead giving up that space for bookshelves and larger hallways. The large shared spaces are out and a communal but distanced concept is in.

The new IWG concept points to a shift in commercial real estate, especially retail landlords, and the coworking industry that the DenSwap team is seeing more and more interest in. The team is talking to landlords that want to explore partnerships with coworking operators to rapidly adapt to this trend or go with a franchise concept. The neighborhood coworking concept going to grow in popularity as we close 2020 and enter 2021.

If you own property or operate a coworking chain looking to grow then schedule a free 15 minute with a DenSwap consultant to learn how we can help.